In today’s data-driven business world, financial accuracy and effective cost control are essential. To manage this, companies rely on smart ERP systems and SAP FICO stands out as one of the most trusted modules in the SAP suite. If you're exploring career paths in finance, accounting, or ERP consulting, starting with SAP FICO can provide you with a strong professional foundation. This guide walks you through the essentials of SAP FICO, explaining what it is, how it works, and what steps to take as a new learner. SAP FICO Online Training provides a flexible and in-depth way to learn financial accounting and controlling through real-time SAP tools, perfect for beginners and professionals alike.

What Is SAP FICO?

SAP FICO combines two key modules of SAP’s ERP system:

FI (Financial Accounting)

CO (Controlling)

Together, they help businesses manage their complete financial operations from legal compliance to internal performance tracking.

The FI module handles everything related to external financial reporting such as general ledger, accounts payable, and financial statements.

The CO module is used internally to monitor costs, manage budgets, and analyze profitability through tools like cost centers and profit centers.

In simpler terms, FI shows what was spent or earned, while CO shows where and why the money moved within the business.

Why Should You Learn SAP FICO?

SAP FICO is a high-demand skill in the finance and ERP job markets. Here’s why:

It simplifies complex financial processes.

It’s widely used by businesses across industries.

It provides real-time financial visibility for decision-making.

It integrates seamlessly with other SAP modules like Sales (SD), Procurement (MM), and HR (HCM).

Mastering SAP FICO not only enhances your knowledge of enterprise finance but also opens doors to roles like SAP consultant, finance analyst, or ERP specialist.

A Beginner’s Path to Learning SAP FICO

Let’s break down the steps to get you started with SAP FICO.

Step 1: Get Comfortable with SAP Basics

Before working with FICO specifically, it’s important to understand how SAP ERP functions overall:

SAP is an integrated software suite that helps businesses run core operations.

The system is divided into different modules, each managing a specific business area.

Learn how to navigate using the SAP GUI, which is the interface through which users access functions and reports.

Once you're familiar with the environment, working with specific modules like FICO becomes much easier.

Step 2: Learn the Core Financial Accounting (FI) Components

The FI module manages financial activities required for compliance and external reporting. Key areas include:

General Ledger (G/L): All financial transactions are recorded here.

Accounts Payable (AP): Deals with outgoing payments to vendors.

Accounts Receivable (AR): Tracks payments due from customers.

Asset Accounting: Records and depreciates fixed assets like buildings or equipment.

Bank Accounting: Manages bank accounts and reconciliations.

These components form the backbone of external financial reporting for any business.

Step 3: Understand the Controlling (CO) Module

The CO module helps companies analyze internal financial performance. It includes:

Cost Elements: Categories of income and expenses.

Cost Centers: Departments or functions where costs are tracked.

Profit Centers: Business units responsible for generating profits.

Internal Orders: Used to track project or campaign expenses.

Activity-Based Costing: Assigns costs based on specific business activities.

This module is essential for internal analysis, budgeting, and optimizing operational efficiency.

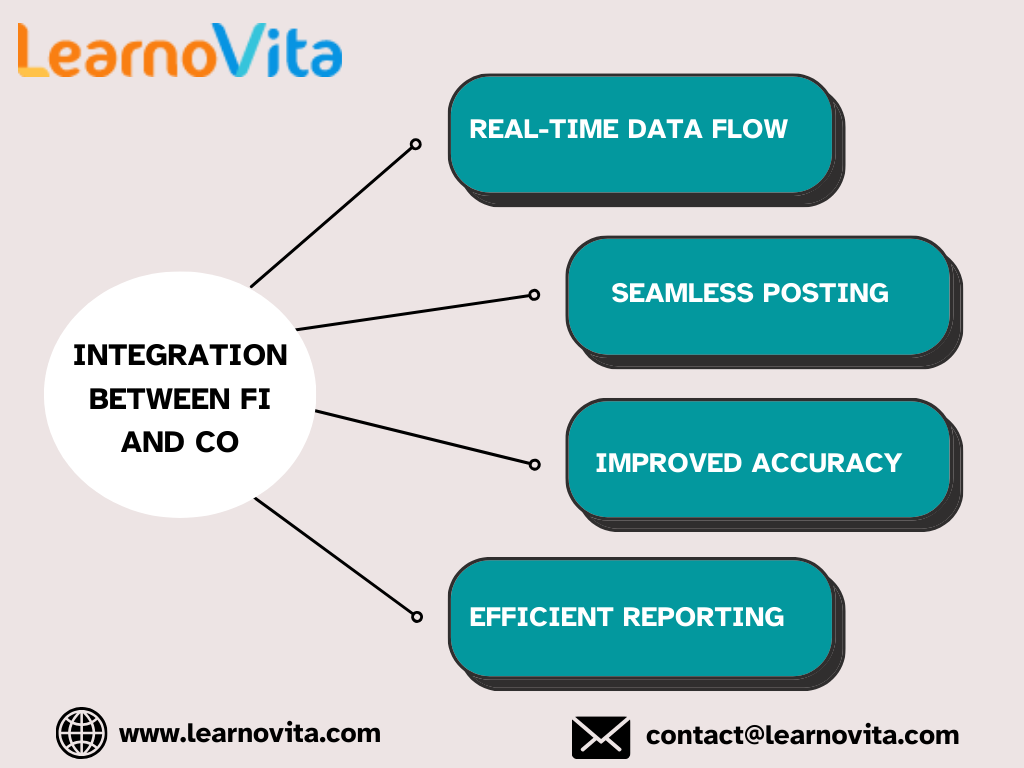

Step 4: Explore the FI and CO Integration

One of the key strengths of SAP FICO is the integration between FI and CO:

Sales recorded in the SAP SD module also update FI and CO automatically.

Purchase orders from SAP MM impact both accounting and cost tracking.

Payroll expenses in SAP HCM reflect in both G/L accounts and cost centers.

This interconnectedness ensures that all departments have access to consistent, real-time financial data. Our Best Training & Placement Program ensures hands-on learning and career support, guiding you from skill-building to securing your dream job.

Step 5: Learn SAP FICO Transaction Codes

SAP functions are executed through transaction codes (T-codes). Some beginner-friendly ones include:

FB50: Post entries directly into the general ledger.

F-02: Manually record journal entries.

F110: Run automatic payment programs.

FS00: Create and manage G/L accounts.

KP06: Plan budgets for cost centers.

KE51: Create new profit centers.

Practicing these transactions is essential to becoming efficient with SAP FICO.

Step 6: Understand the Configuration Process

In SAP, configuration means setting up the system based on a company’s structure and policies. As a beginner, you’ll eventually need to explore how to:

Set up company codes, fiscal years, and chart of accounts

Define posting periods, document types, and tax codes

Customize financial reporting formats and internal control mechanisms

Configuration is an important step for those looking to become SAP consultants or implementation specialists.

Step 7: Learn About FICO Reports and Analytics

SAP FICO provides comprehensive financial and management reports, including:

Balance Sheets

Profit and Loss Statements

Cash Flow Reports

Trial Balances

Cost and Profit Center Analysis

Understanding how to generate and interpret these reports is key to using SAP effectively in real-world finance roles.

Step 8: Practice and Get Certified

To gain real-world experience and improve your resume:

Use SAP practice systems or training servers for hands-on learning.

Enroll in a professional SAP FICO training course (online or in-person).

Work toward the SAP FICO Certification, a globally recognized credential.

Explore SAP S/4HANA FICO, the latest version built for high-speed performance and simplified finance structures.

Practical experience combined with certification is the best way to stand out in the job market.

Final Words

SAP FICO is the financial heartbeat of many global enterprises. For beginners, it might seem complex at first, but breaking it down into structured steps makes it easier to understand. As you progress from basic concepts to transactions, and eventually to configuration and reporting, you’ll find SAP FICO to be a rewarding tool to learn. Whether you’re aiming for a career in accounting, finance, or IT consulting, starting with SAP FICO will equip you with the skills to thrive in a digitally integrated business world.

Write a comment ...